The Overlooked Investing Principle That Reduces Long-Term Financial Stress

Most people already know the basics of investing.

☛ Start early.

☛ Be consistent.

☛ Let compounding do the heavy lifting.

These ideas are widely shared, frequently repeated, and rarely disputed.

And yet, many capable, intelligent professionals still struggle to put them into practice.

Not because they don’t understand investing —

but because understanding alone doesn’t survive real life pressure.

This struggle is especially common among high-responsibility professionals who understand investing in theory, but feel overwhelmed when it comes to consistent, long-term action.

This article explores why compounding often fails in real life, especially for high-responsibility professionals — and why structure, not discipline, determines long-term financial resilience.

Why Investing Feels Hard Despite Knowing What to Do

For many people today, investing decisions are made in crowded mental space.

You may be:

- Building or sustaining a demanding career

- Supporting children, parents, or both

- Managing rising living costs and uncertainty

- Carrying the quiet responsibility of “not being allowed to fail”

In this context, investing no longer feels like a neutral, long-term plan.

It feels like:

- Another decision that could go wrong

- Another commitment you might regret

- Another thing competing for limited attention

So people pause.

They wait for:

- More clarity

- More time

- More confidence

What often goes unnoticed is that waiting has a cost, even when no money is lost.

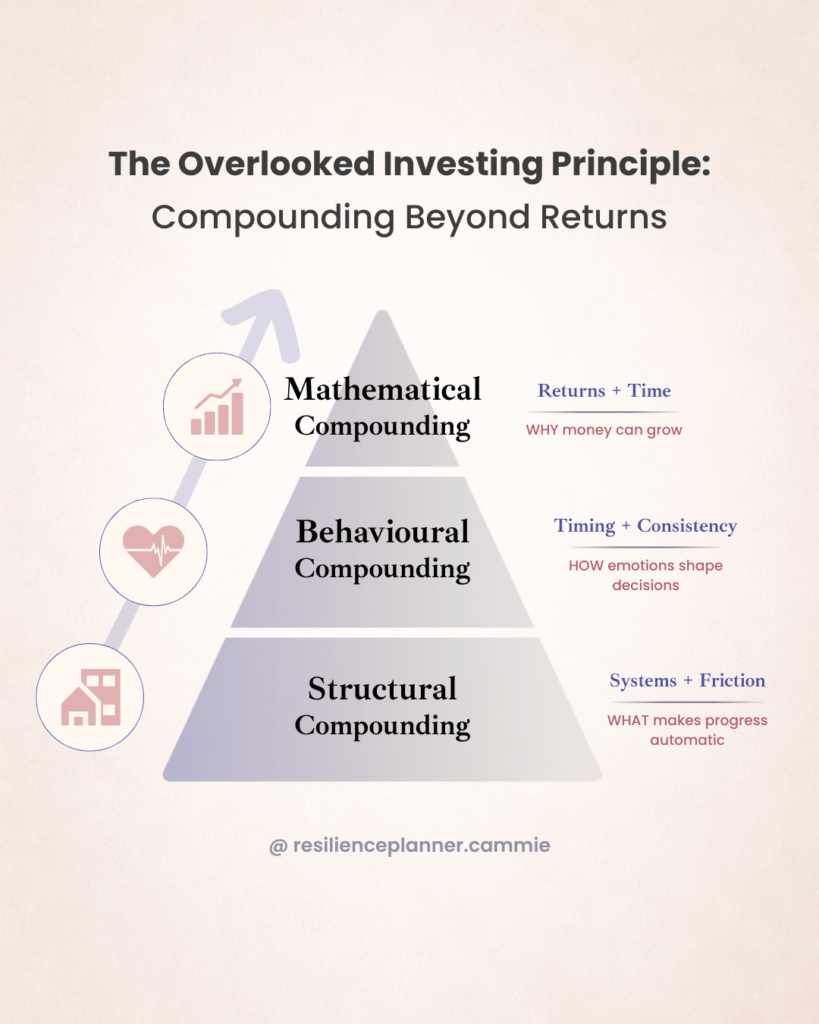

Compounding in Investing: More Than Just Returns

Compounding is usually explained as a mathematical concept — interest earning interest over time.

That explanation is correct, but incomplete.

In reality, compounding in investing operates across three interconnected layers.

1. Mathematical Compounding

This is the visible layer:

returns, growth rates, and time.

It explains why money can grow —

but not whether it actually will.

2. Behavioral Compounding

This layer determines consistency.

When decisions feel stressful or uncertain:

- Contributions become irregular

- Market movements trigger emotional reactions

- Long gaps form between “intended” actions

Small interruptions may seem harmless, but over years, they quietly compound into lost momentum.

3. Structural Compounding

This is the most overlooked layer.

Structure determines whether progress continues by default, or only when motivation is high.

Without structure:

- Every action requires fresh effort

- Every decision is reconsidered

- Every pause risks becoming permanent

With structure:

- Progress continues quietly in the background

- Decisions are simplified, not repeated

- Action doesn’t depend on mood, timing, or market noise

Compounding works best when it removes decisions — not when it demands discipline.

There is an old Malay proverb that captures this idea perfectly:

“Sedikit-sedikit, lama-lama jadi bukit.”

Little by little, over time, it becomes a mountain.

Not through intensity.

Not through perfection.

But through steady movement that continues even when attention shifts elsewhere.

structure determines whether progress continues.

The Hidden Cost of Delaying Investing

Many people assume that starting later simply means investing more aggressively later.

In practice, delaying often leads to:

- Higher pressure to “catch up”

- Reduced margin for error

- More emotionally charged decisions

- Fewer options during life transitions

When time is abundant, flexibility exists.

When time is compressed, every decision feels heavier.

This is why compounding isn’t just about growth.

It’s about reducing future pressure.

Early structure gives you:

- More breathing room

- More adaptability

- More choice during uncertain seasons

Why Many Professionals Avoid Long-Term Investing

If compounding is so powerful, why is it so commonly overlooked?

This is not a knowledge gap. It’s a behavioural investing problem — where emotional safety matters more than technical correctness.

Because most financial conversations focus on:

- Products

- Performance

- Predictions

Very few address:

- Decision fatigue

- Fear of irreversible mistakes

- Emotional safety before commitment

- The mental cost of uncertainty

When planning feels like a permanent, all-or-nothing decision, avoidance feels safer than engagement.

And when advice jumps too quickly to solutions, people retreat — not because they don’t care, but because they don’t yet feel steady.

A Safer Way to Think About Financial Progress

Progress does not require perfect clarity.

It requires:

- Knowing what matters now

- Knowing what can safely wait

- Having a structure that supports action even during busy or uncertain periods

Sustainable investing progress isn’t built through chasing returns.

It’s built by designing a financial structure that compounds calmly across different life seasons — reducing decision load while preserving long-term resilience.

Most people don’t need more information.

They need a calmer way to see where they stand — and what deserves attention first.

When financial decisions are grounded in structure rather than urgency, clarity replaces overwhelm. And from that place, progress becomes not only possible, but sustainable

You Don’t Have to Figure This Out Alone

If this raised questions about your finances, a Clarity Call gives you space to pause and see your situation more clearly.

In this conversation, we focus on:

• where your financial structure stands today

• what deserves attention now — and what can wait

• the next steady step forward, without pressure

A calm, no-pressure conversation to help you move forward with clarity.

Disclaimer: This content has not been reviewed by the Monetary Authority of Singapore and is not affiliated with or endorsed by any Singapore government agency. References to “Singapore” refer only to the geographical area served. The information is for general knowledge and educational purposes only, is accurate at the time of writing, and may be subject to change. It should not be considered financial or legal advice. Please consult a licensed financial advisory representative or legal advisor for personalised recommendations. E&OE.

About the author: Cammie currently holds a financial advisory license for distribution of insurance and collective investment scheme products, and has an Estate Succession Practitioner certification. Trained as an Architect and being a brain tumour survivor, she identifies herself as The Resilience Planner in Personal Finance. Her approach to financial advisory is consultative – she encourages her clients to be participative and ask questions. She believes that because Personal Finance is personal, she works with clients to create tailored solutions that suit each individual’s unique needs and life goals.